Monday, January 29, 2007

More on the Minimum Wage Debate

Representative Rob Andrews (D-NJ) welcomed this new government decree to increase wages with the following:

“When the tax bill was on the floor, the wealthiest people in the country, people making more than $300,000 a year wanted massive tax breaks. It was their day, and they got it. I am sorry to disappoint the opponents of the minimum wage, but this is not your day. This is the day for the people who empty the bed pans, change the bed linens, sweep the floors, and do the hardest work of America. After a 10-year wait… this is their day.”

I don’t question the fact that Rep. Andrews has the ability to create beautiful prose, but I do feel that his rhetoric, which totally disregards the facts, is dangerous. First, he states that the tax cuts were passed for the very rich. However, this ignores the fact that the 2001-2003 tax cuts lowered the average tax bill of those taxpayers earning below $50,000 by 47%. This decrease was larger than the decrease of the middle to upper middle class which saw a cut of only 20%. He also misleads us about hospital workers who ‘empty (our) bed pans.’ In fact, only 1.8% of hospital workers earn the minimum wage. Obviously he did not fact check before he approached the house floor.

Sunday, January 28, 2007

Dangerous Rhetoric

"When one looks at the health of our economy, it's almost as if we are living in two different countries. Some say that things have never been better. The stock market is at an all-time high, and so are corporate profits. But these benefits are not being fairly shared. When I graduated from college, the average corporate CEO made 20 times what the average worker did; today, it's nearly 400 times."

While I agree that not all CEOs deserve the pay they get. However, who are we to judge other people. The people who lose when CEOs have big pay days are stockholders. Why should we care if stockholders lose? We should not be fooled by populists who think poor people would be paid more if CEOs were paid less. Next, Mr. Webb cites inequality:

"Wages and salaries for our workers are at all-time lows as a percentage of national wealth, even though the productivity of American workers is the highest in the world. Medical costs have skyrocketed. College tuition rates are off the charts. Our manufacturing base is being dismantled and sent overseas. Good American jobs are being sent along with them."

Here, Mr. Webb uses the old labor economist's argument of stagnating wages. But even the NYT cites that real average hourly pay rose by 1.6%, one of the highest increases in the past 30+ years. But, the problem with using stagnating wages as a measure of the American worker's prosperity is that is incomplete. Over the past thirty years, prices of goods have fallen considerably. For example, a worker at an assembly plant can easily afford a flat screen TV and a new bicycle at Wal-mart. This was not the case thirty years ago. Also, the wealth of lower class workers has also increased dramatically due to two recent phenomenon: the appreciation of homes and the record amount of the American public owning their own home (70% in 2004). Next, Mr. Webb shows his ignorance:

"Our white-collar professionals are beginning to understand it, as their jobs start disappearing also. And they expect, rightly, that in this age of globalization, their government has a duty to insist that their concerns be dealt with fairly in the international marketplace."

Jobs are disappearing. That is funny. Actually, employers can't find enough people to work for them. We are almost at full employment. The 4.5% unemployment rate is almost as low as it was in 2000, which was the lowest rate of unemployment since 1969. As for globalization, the only way that the American people would be hurt by it is if the government tries to shield the American people from it. We should all take note. The Democrats want to retreat from globalization while the Republicans (at least most of them) want to embrace it.

The next time you think of voting Democrat just think about what one of their icons says in the NYT:

“In the past, the attitude was, ‘Get government out of the way.’ And now it’s, ‘Gee, I may need it.’ ”Lord save us if they keep this rhetoric up.

Saturday, January 27, 2007

Minimum Wage Debate

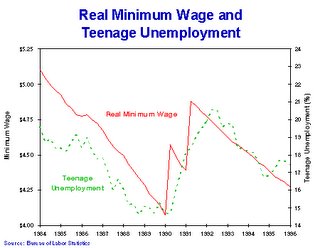

As you can see, there seems to be a correlation between the real value of the minimum wage and the unemployment rate for teenagers. This proves two points. First, the minimum wage affects mostly teenagers. And second, as the minimum wage rises, unemployment will rise along with it.

While this increase in unemployment should not be seen in the total unemployment rate, it should be interesting to watch the unemployment rate for teenagers over the next couple of years.

Thursday, January 25, 2007

More Government Meddling (and some BOD incompetence)

"I am not a fan of mergers. I don't think that (mergers) give consumers more choices, it gives them fewer choices," he said.It is amazing that Sen. Dorgan is so omniscient when it comes to economics and finance. For him to predict the results of a US Air-Delta merger is pretty impressive. There are numerous issues that he obviously knows the answers to:

-Will they gain pricing power through the merger which could raise prices?

-Is the airline industry competitive enough that the merger won't effect prices?

-Will scale economies result from the merger resulting in either lower (not higher) prices or better service?

-Will this create more or less routes for travelers?

-Will the merged company be able to pay off its debt load?

Even Republican Senators got in on the action:

"We're going to lose service, and also I think lose out on higher prices," Sen. Olympia Snowe, R-Maine, told Parker. "It's hard to believe that you will continue the same service."It is amazing that they know the answers to these questions. They should retire and start making money on Wall Street since they understand M&A so well.

One last note: I think it is criminal for the Board of Delta to reject the hostile takeover. Delta is going down the drain. Poor service, Chapter 11 status, etc. The takeover is an opportunity for shareholders to recover what is left of their stock's value. We shall see what the creditor's decide on in the coming week. If you are a betting man, buy DALRQ now. As for me, I will pass.

To read more about Delta's decision regarding the US Airways hostile takeover attempt, go to Delta's Press Release. I will admit that they have some strong arguments.

Thursday, January 18, 2007

Statistically Speaking

As for the people who say that we are having the warmest winter EVER! This is not correct. We only have something like 130 years of data on world temperature but the world is billions of years old. So when somebody says that today is the hottest day EVER, you should question them. Because what they are really saying is that today is the hottest day in 130 years. But does this mean anything? 130 years out of a billion years in a VERY small sample and making any assumption from this small sample would not beat any statistical test of significance.

Tuesday, January 16, 2007

One Trillion Dollars

The US trade deficit with China is big but it only represents 30% of our trade deficit. Many other countries with flexible exchange rates contribute to the other 70%. I won't argue that the fixed Yuan does not matter and I do believe it is holding back the correction that is needed for global imbalances. However, I believe the people who SHOULD be complaining are the Chinese people. China's fixed exchange rate could lead to:

-Inflation problems

-The worsening of the banking sector

These are a result of the interventions and sterilizations by Chinese officials that are needed to maintain the exchange rate and keep money supply from getting out of control. This highlights how China is still not economically free:

"China keeps about two-thirds of the reserves in dollars and is the second-largest owner of U.S. treasuries after Japan, holding $344.9 billion in October. Concern that a weakening dollar may erode the value of the holding is encouraging China to diversify and central bank Deputy Governor Wu Xiaoling said in November that the bank had been buying yen."

The money holed up in reserves could be used on assets earning real returns for the Chinese people. Added to this restriction on economic freedom is the limitation on foreign currency exchange. The Chinese people have to ask their government if they can have dollars or Euros or Yen and they are limited to how much they can receive. However, it is promising to see some of these controls being relaxed:

"The government relaxed currency controls and eased rules on companies and individuals investing abroad in 2006. The amount of foreign currency that individuals can buy is doubling to $50,000 a year from Feb. 1."I think the uplifting part of this story is the following:

"The central bank's announcement on currency reserves is less than a week after China's stock market capitalization exceeded $1 trillion for the first time, underscoring the growing might of an economy that has expanded 10-fold since it was opened to international investment in 1978."This is good for America and the world. Let us not be fooled by Democrats in Congress who want to close our borders between the US and China. We must embrace China and if we do, both countries will benefit with further growth and further prosperity.

Saturday, January 13, 2007

Anti-Walmart Sentiment in NYC

-The leader of most of the protests (Joseph Kizelnik) is the owner of the store that sits next to the empty lot. The store is a discount store and I would assume would probably shut down if Walmart were allowed to compete with it. This might sound bad but the store Kizelnik runs probably employs a lot less people than Walmart would employ if it was allowed to operate in Monsey. Also, I am sure Walmart will save local families a lot more money. Net result - more money for the community.

-Kizelnik claims that Wal-mart "will bring in very low-level people, and if these low-level people come in they are going to follow us to our homes, and ransack our homes." This is pure elitism and racism. Wal-mart might attract low-income shoppers because of its low prices. However, to deny the poor access to cheap goods because Monsey residents are afraid of them is absurd.

-A local legislator highlighted an interesting fact about the community in question:

"Bruce Levine,... a Wal-mart foe, recalls that in those days (the 1950's and 1960's) the main street in the town centre at Spring Valley was the place to go shopping for a suit at Nat Kaplan's, or to EJ Korvette's, the discount store chain that was one of the first to establish a model that was so successfully followed by Sam Walton."This quote highlights how an economy works. Businesses go out of business. Competition brings better stores to the area which closes down older stores. However, the new stores have better jobs and offer better products. This should not be something we lament, it should be something we enjoy seeing.

-The most entertaining part was when Wal-mart came to town to tell the protesters why they were wrong. However, not many protesters came to listen. They did not want to hear another side of the argument. But, who did show up?

"The event was sparsely attended, attracting a few residents and a couple of businessmen interested in supplying the new store."-Government officials don't realize what a Wal-mart could do for government such as increases in revenue due to the property taxes a Supercenter would pay.

-The most laughable part of the piece was when the FT discussed the actual protest that occurred recently against the proposed Wal-mart.

"In early December, the UFCW staged what Lipsky says will be the first of a series of public demonstrations against the store - an event which the largest group consisted of union members bussed in from New Jersey."People should not be afraid of Wal-mart. They supply 1.8 million people with jobs. They save the average American family $2,300 a year due to lower prices. And they are an American success story. A result of freedom and capitalism...